How Much Equity Should Startups Give Investors? SEIS, EIS & Early-Stage Valuations Explained

Raising investment is one of the most important milestones for any startup. But how much equity should you actually give away to investors – particularly in your first SEIS or EIS round? The balance is delicate: raise too little and you starve the business of growth capital; give away too much and you risk losing control of your company.

In this guide, we break down how much equity to give investors at each stage, typical startup valuations in the UK, and the legal considerations founders need to understand when raising early-stage funding.

Why Equity Percentages and Valuation Matter

Equity fundraising is always a negotiation between investors’ appetite for risk and a startup’s potential. However, undervaluing your business can be just as damaging as overpricing it.

For example, offering 20% equity for a £12,000 investment implies a valuation of just £60,000. Even for a pre-revenue startup, this is extremely low.

The risks include:

- Excessive dilution: giving away too much equity too soon can push founders below 50% ownership, risking long-term control.

- Future investor deterrence: institutional SEIS/EIS investors often expect 15–25% for £100,000-£250,000 investments. If an early angel already owns 20%, it can make your cap table unattractive.

- Valuation credibility: subsequent investors may question why the company was initially valued so cheaply, undermining confidence in future rounds.

Typical Equity Ranges in UK Startup Fundraising

While every business is unique, the following benchmarks are commonly seen in the UK early-stage funding ecosystem:

- Pre-revenue, pre-MVP (friends & family / angel stage)

- Raise: £25,000-£75,000

- Equity: 5-10% in total

- Valuation: £250,000-£750,000

- Pre-revenue, MVP in place (SEIS-qualifying)

- Raise: £50,000-£150,000

- Equity: 10-15%

- Valuation: £300,000-£1m

- Early traction / revenue stage (larger SEIS/EIS rounds)

- Raise: £150,000-£500,000

- Equity: 15-25%

- Valuation: £1m-£3m

- Growth stage (EIS/VC rounds)

- Raise: £500,000-£2m+

- Equity: 20-30%

- Valuation: £2m-£10m+

These ranges reflect typical investor expectations. Founders should aim to strike a balance: rewarding investors for their risk while retaining enough ownership for future rounds.

Legal Considerations for Startup Equity Deals

When raising funds, UK founders should carefully manage both the legal and commercial aspects:

- Shareholder Agreements: set out voting rights, exit provisions, and investor protections.

- Pre-emption Rights: give existing investors the option to participate in later rounds.

- Investor Protections: while preference shares are rare at SEIS/EIS stage, they become more common in VC rounds.

- SEIS/EIS Compliance: ensure HMRC approval for tax relief, as this is often critical for securing angel investors.

- Cap Table Planning: model future rounds so you don’t run out of equity to offer.

- Valuation Rationale: prepare evidence (sector comparables, market opportunity, founder track record) to justify your valuation to investors.

Practical Tips for Founders

- Plan 2-3 rounds ahead: avoid short-term deals that compromise your future fundraising options.

- Retain founder control: aim to hold at least 70-80% after your first raise.

- Spread investor ownership: avoid giving one small investor a disproportionate stake.

- Use SEIS/EIS effectively: market your round as tax-efficient to attract angel investors.

- Seek professional advice: lawyers can structure deals to protect your interests while meeting investor expectations.

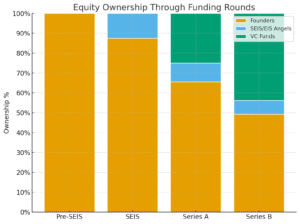

Example: How Founder Ownership Dilutes Across Funding Rounds

Let’s take a hypothetical startup raising at pre-revenue, SEIS, Series A, and Series B stages.

| Round | Investment Raised | Post-Money Valuation | % Issued to New Investors | Founder Ownership (combined) | Early Angels (SEIS/EIS) | VC Funds |

| Pre-SEIS (founders only) | £0 | £0 | – | 100% | – | – |

| SEIS Round | £100,000 | £800,000 | 12.5% | 87.5% | 12.5% | – |

| Series A (EIS/VC) | £1,500,000 | £6,000,000 | 25% | 65.6% | 9.4% | 25% |

| Series B (VC-led) | £5,000,000 | £20,000,000 | 25% | 49.2% | 7.0% | 43.8% |

Key Lessons

- Founder control erodes over time: but careful planning ensures founders still own nearly 50% by Series B, which is strong compared to industry norms.

- SEIS/EIS investors are diluted too: while they start with 12.5%, they reduce to 7% by Series B, which is still a meaningful stake.

- VCs take larger chunks: Series A and B funds together hold nearly 45%, but this is acceptable given the capital injected.

Conclusion

Early fundraising is about more than just cash, it’s about setting your company’s trajectory. Understanding how much equity to give investors at each stage, from SEIS to Series A and beyond, is vital for protecting your company’s future. By planning your valuation strategy, keeping a healthy cap table, and ensuring legal compliance (particularly with SEIS/EIS), you can secure the funding you need while retaining long-term control.

Contact Us

If you require support, we offer a no-cost, no-obligation 20-minute introductory call as a starting point or, if you prefer more detailed initial guidance, we can provide a one-hour fixed fee appointment (charged from £250 plus VAT to £350 plus VAT* depending on the complexity of the issues and seniority of the fee earner).

Please email wewillhelp@jonathanlea.net providing us with any relevant information so that our call can be as productive as possible, or call us on 01444 708 640.

FAQs:

Early-Stage & SEIS/EIS

-

How much equity do SEIS investors usually take?

-

SEIS investors typically receive 10–15% of the company in total, spread across several investors. It is unusual for a single investor to hold more than 10% at the SEIS stage, as too much early dilution can create problems later. Competition & Markets Authority, having to adjust your pricing and possibly pay penalties.

-

Can I raise money before I have revenue?

-

Yes — many SEIS-qualifying startups are pre-revenue when they raise their first round. Investors at this stage base valuation on the founding team, the MVP (minimum viable product), and the market potential. Pre-revenue valuations typically fall between £250,000 and £1m, depending on sector and traction.

-

What is a “fair” valuation for a pre-revenue startup?

-

There is no fixed formula, but most UK pre-revenue startups raise at valuations between £300,000 and £1m. Anything significantly lower risks undervaluing the business, while anything much higher requires strong founder credentials or evidence of traction.

-

Can I raise SEIS and EIS money together?

-

Yes — many companies structure their early round as a mix of SEIS (up to £250,000) followed by EIS (up to £12m). Investors benefit from different levels of tax relief, so rounds are often split into SEIS shares first, then EIS shares once the SEIS limit is reached.

Later-Stage VC Investment

-

How much equity do venture capital funds expect?

-

Venture capital investors typically expect 15–30% ownership per round, depending on the amount raised, company stage, and sector. They also often require board seats and enhanced investor protections.

-

What is considered a “healthy” cap table at Series A or B?

-

At Series A, founders are ideally still holding 60–70% of the company combined, with investors making up the rest. By Series B, founder ownership often reduces to 40–50%, but maintaining a significant stake is crucial for motivation and control.

-

What investor rights do VCs usually demand?

-

VCs often seek preference shares (with liquidation preferences), anti-dilution rights, veto rights on major decisions, and board representation. These protections are designed to de-risk their investment.

-

How do VCs value later-stage startups?

-

Valuation at VC stage is usually based on a multiple of revenue (for SaaS, often ARR multiples), market traction, growth rate, and sector comparables. Unlike SEIS/EIS rounds, which rely heavily on projections, VCs typically want measurable traction before investing.

-

Can having too many small angel investors affect VC appetite?

-

Yes. VCs often prefer a “clean” cap table. If dozens of small angels hold fragmented stakes, it can complicate decision-making and reduce the space available for institutional investors. Founders should consolidate or manage angel stakes carefully to avoid this issue.

*VAT is charged at 20%

This article is intended for general information only, applies to the law at the time of publication, is not specific to the facts of your case and is not intended to be a replacement for legal advice. It is recommended that specific professional advice is sought before relying on any of the information given. © Jonathan Lea Limited.