Private Equity Legal Services for SMEs and Growing Businesses

Private Equity Legal Services for SMEs and Growing Businesses

Clear, practical legal advice for private equity investment in small to mid-sized companies.

Private equity investment can be transformative for growing businesses, but it is also complex, high-stakes, and often unfamiliar territory for founders and management teams. At Jonathan Lea Network, we advise SMEs, founder-led businesses, and management teams on private equity and growth capital transactions, with a clear focus on commercial outcomes, risk management, and long-term value creation.

As a small but growing UK law firm with a strong corporate practice, we are particularly well placed to advise on private equity transactions in the SME and lower mid-market space. Our size allows us to be agile, partner-led, and cost-effective, while our experience ensures we can handle sophisticated transactions involving institutional investors with confidence.

We act as trusted advisers throughout the full investment lifecycle, from early-stage planning and negotiation, through investment and governance implementation, to eventual exit.

To find out more about our Private Equity Legal Service please continue to read below, or click on one of the following pages for more detailed information on each of these areas.

Private Equity Legal Services for SMEs and Growing Businesses

Private Equity Legal Advice for Target Companies and Founders

What it means to be advised as the investee business or founder: We primarily act for target companies, founders, and management teams receiving private equity investment. Acting for the investee side requires a fundamentally different approach from acting for investors. Our role is to protect the long-term interests of the business and its leadership, while still facilitating a transaction that supports growth and investor objectives.

Private equity investment often introduces new governance structures, enhanced reporting obligations, and changes to control dynamics. We help clients understand how these mechanisms work in practice, what is market standard, and where negotiation is both possible and advisable. This includes negotiating terms with institutional investors who are typically highly experienced and well advised, ensuring founders and management are not disadvantaged through imbalance of experience.

Sell-Side M&A Advice in Private Equity Transactions

How to prepare for and manage a private equity-backed sale or investment: Selling a business to a private equity investor, whether through a minority investment, majority sale, or full exit, can be one of the most significant events in a founder’s career. We provide comprehensive sell-side M&A advice tailored to private equity transactions, designed to reduce risk, preserve value, and maintain deal momentum.

- Transaction strategy and structuring

We advise on the optimal deal structure, including minority versus majority investments, full exits, rollover equity, and earn-out mechanisms where appropriate. Our advice is grounded in aligning personal objectives with commercial realities and future exit potential. - Negotiation with private equity buyers

We lead negotiations on key commercial and legal points, including price mechanics, locked box versus completion accounts structures, warranties, indemnities, and risk allocation. Our focus is on achieving balanced outcomes that reflect the true risk profile of the business. - Managing the sale process

We manage the legal workstream, including data room preparation, responses to due diligence queries, and coordination with corporate finance, tax, and accountancy advisers, ensuring an efficient and well-controlled process.

Investment Agreements and Shareholder Agreements Explained

Understanding the documents that govern your relationship with investors: Private equity transactions are underpinned by a suite of interrelated legal documents that define both the economics of the deal and the post-investment governance of the business. We advise from the earliest stages, including review and negotiation of term sheets or heads of terms, through to completion documentation.

- Investment and share purchase agreements

These documents govern valuation, consideration, warranties, indemnities, and post-completion obligations. We advise on limitations on liability, including caps, baskets, de minimis thresholds, and time limits on warranty claims, ensuring risks are proportionate and clearly understood. - Shareholder agreements and articles of association

These documents regulate how the company is run following investment. We advise on voting rights, reserved matters, board composition, dividend policy, drag and tag rights, and exit provisions, helping founders retain appropriate influence while meeting investor expectations.

Management Incentive Plans (MIPs) for Private Equity Deals

Aligning incentives while protecting long-term outcomes: Management incentive plans are a central feature of most private equity transactions and can have a significant impact on founder and management outcomes on exit. While potentially highly rewarding, MIPs are complex and often heavily negotiated.

- Structuring equity incentives

We advise on growth shares, sweet equity, options, and other incentive arrangements, including alignment with EMI or other tax-advantaged schemes where available. We explain the commercial and tax implications in clear, practical terms. - Protecting management interests

We negotiate leaver provisions, vesting schedules, and exit mechanics, including treatment on IPOs, secondary sales, or continuation fund transactions, ensuring management understands how value will be realised in different scenarios.

Corporate Due Diligence Services for Private Equity Investment

Preparing for scrutiny and managing legal risk: Legal due diligence is a core element of private equity investment and can feel intrusive for founders. We help clients prepare thoroughly and manage issues pragmatically to avoid delays and value erosion.

- Pre-transaction readiness

We identify and address issues in advance, including corporate structure, IP ownership, key commercial contracts, employment arrangements, and data protection compliance. - Clear and commercial reporting

Our advice focuses on material risk rather than technical detail, helping clients understand which issues matter commercially and how they can be mitigated.

Corporate Restructuring and Reorganisations

Getting the business structure investment-ready: Private equity investors often require corporate restructurings as a condition of investment. We advise on and implement restructurings efficiently and with minimal disruption.

- Group and share capital reorganisations

This includes the implementation of new holding company or TopCo structures, share capital reorganisations, and simplification of group arrangements. - Future-proofing the business

We ensure structures support future bolt-on acquisitions, follow-on private equity investments, and longer-term exit strategies, including buy-and-build growth models.

Employment and Founder / Management Advisory

Protecting personal and commercial positions post-investment: Private equity investment often brings changes to employment terms, governance rights, and accountability. We advise founders and senior management on how these changes affect them personally.

- Service agreements and restrictive covenants

We negotiate service agreements, good leaver and bad leaver provisions, and post-termination non-compete and non-solicitation clauses, ensuring terms are fair and enforceable. - Balancing control and accountability

We help management understand how investor oversight operates in practice and how performance expectations are tied to equity outcomes.

Commercial Contracts Review in Private Equity Transactions

Understanding and protecting contractual value: Key commercial contracts often underpin valuation and deal certainty. We review material agreements as part of the investment process.

- Change of control and termination risk

We assess whether investment could trigger termination or renegotiation rights and advise on mitigation strategies. - Strengthening contractual positions

Where appropriate, we assist with extending contract terms, clarifying service levels, or renegotiating key customer or supplier provisions ahead of completion.

Regulatory and Compliance Advice for SME Private Equity Deals

Avoiding regulatory surprises and delays: Regulatory compliance is increasingly scrutinised in private equity transactions, even in the SME sector.

- Sector-specific compliance

We advise on relevant UK regulatory regimes, including data protection, sector-specific licensing, and FCA considerations where applicable. - Risk mitigation

We explain how regulatory risk feeds into warranties, indemnities, and conditions precedent, helping clients understand both legal and commercial consequences.

Exit Planning and Founder Advisory

Planning for exit from the outset: Private equity investment is typically part of a longer journey rather than an endpoint. We advise clients on exit planning from day one.

- Building exit-ready governance

We help implement governance frameworks that support a future sale or refinancing. - Maximising value on exit

We advise on preparing for secondary buy-outs, trade sales, or IPOs, depending on the agreed long-term strategy.

Why Choose Jonathan Lea Network for Private Equity Legal Services

Trusted advisers for SME and lower mid-market private equity transactions: Jonathan Lea Network combines the technical strength of a high-quality corporate practice with the accessibility and value for money that founder-led and growing businesses value.

- Partner-led advice throughout

Clients work directly with experienced lawyers who understand both legal complexity and commercial reality. - Focused on SMEs and founders

Our experience advising on SME and lower mid-market transactions allows us to tailor advice to the specific pressures founders and management teams face. - Clear, commercial, and cost-conscious

We prioritise clarity, efficiency, and value, collaborating seamlessly with corporate finance, tax, and accountancy advisers.

Speak to Our Private Equity Lawyers Today

Practical, trusted legal advice for private equity investment.

If you are considering private equity investment, preparing for a sale, or navigating a post-investment relationship, Jonathan Lea Network can help. Call us on 01444 708640 or email wewillhelp@jonathanlea.net to arrange an initial consultation about your private equity transaction and discuss how we can support your next stage of growth.

Private Equity FAQs

Private equity typically involves investing in more established, profitable businesses, often with a focus on operational improvement and exit planning, whereas venture capital usually targets earlier-stage, higher-growth companies. Control depends on the size of the investment and negotiated governance rights. Many founders retain significant influence through board representation and reserved matters, even following a majority sale. While not mandatory, in many sponsor-led deals investors expect a MIP as part of the standard package to align management incentives with exit outcomes. Yes. Many SMEs go through multiple investment rounds. Early legal structuring can significantly simplify future transactions. Ideally before or at the heads of terms or term sheet stage, as early advice often leads to stronger negotiating positions and fewer surprises later.

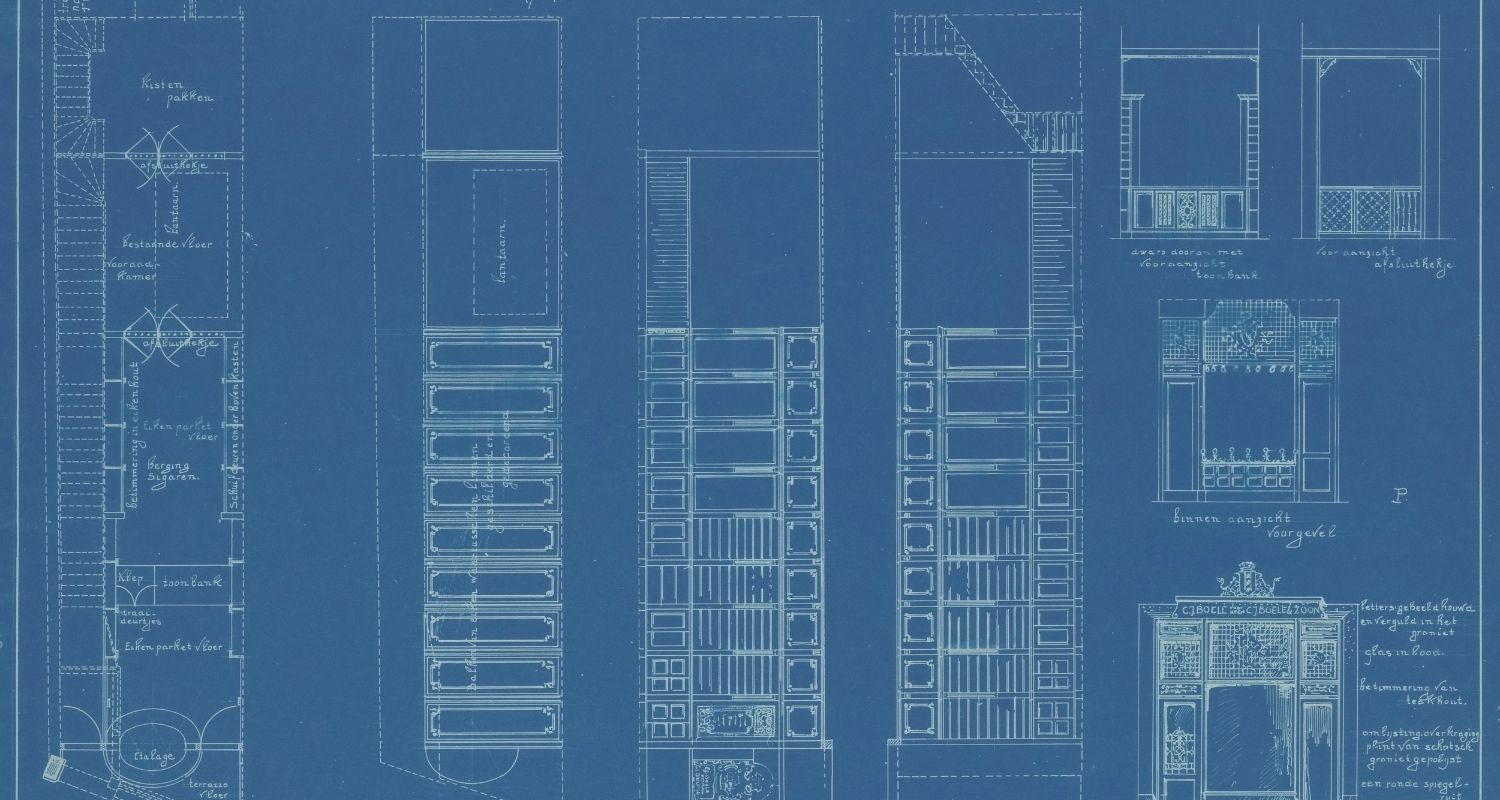

Photo by Amsterdam City Archives on Unsplash

Our Private Equity Team

What Our Clients Say

Request a Free

No Obligation

20 Minute Call

This introductory call is to discuss your matter so we can provide a well-considered quote.

However, please be aware that the free 20 minute call is at our discretion. If you are more looking for advice and guidance on an initial call, we may instead offer a one-hour fixed fee appointment instead.

Our fixed fee appointments are between £250 plus VAT to £350 plus VAT* depending on the complexity of the issues and seniority of solicitor taking the call